This is the first of several articles that I will write on money management and I can assure you that if you take the content seriously and put it into action it can well make the difference between blowing up your account or becoming a long-term successful and profitable currency trader.

The much neglected process of money management is about assessing trades for the risk as well as the potential profit and determining how much risk is acceptable before deciding whether to take or deciding to let it pass, and then, based on that assessment, further controlling risk and maximise profitability while in the trade.

Many traders either ignore or do not understand money management and waste a considerable amount of their time and energy searching for the “perfect” system or entry while completely ignoring money management. This time spent on searching for the Holy Grail would be much better spent learning and implementing money management strategies and this is one of the key areas that is the undoing of most traders.

Many traders either ignore or do not understand money management and waste a considerable amount of their time and energy searching for the “perfect” system or entry while completely ignoring money management. This time spent on searching for the Holy Grail would be much better spent learning and implementing money management strategies and this is one of the key areas that is the undoing of most traders.

A Trading Genius (perhaps).

Despite less than two years in the market a trader I knew a trader was having such spectacular success that it made the excellent returns that I and others in my group were achieving quite shabby by comparison. I asked him how much he risked on each trade and how he managed his stops. He explained to me that he didn’t like to take losses and with his system he didn’t need stops. In 2008 the situation looked quite different, he was selling property and other valuable assets to avoid bankruptcy, actually to be more specific his wife was taking action to close trades, hedge positions and minimise losses, he was effectively emotionally paralysed. Meanwhile we were having the best year ever. It was a devastating year for many traders who learnt the value of money and risk management very harshly and quickly.

Life is a tough teacher it often gives you the test before you get the lesson.

Drawdown

Drawdown analysis is the best way of demonstrating the importance of money management.

Drawdown is defined as the amount of money you lose trading as a percentage of your total trading capital. Drawdown is an inevitability of trading and is not measure of overall performance just a measure of the amount of money lost while achieving that performance. If we didn’t experience any losses our drawdown would be zero.

Maximum drawdown is the largest percentage drop in your account between equity peaks. In other words, it’s how much money you lose until you get back to breakeven. If you began with $10,000 and lost $3,000 before getting back to breakeven, your maximum drawdown would be 30%. It is important to note that regardless of how much you have increased your account by, a 100% drawdown will completely wipe out your trading account.

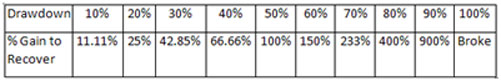

The best way of understanding this aspect of trading is to look at the difficulty of recovering from a drawdown and the percent gain necessary to recover. Many people think that if you lose 20% of your account you only have to make 20% to recover your loss. Sadly, this is not true.

If you started with $10,000 and lost 20% this would leave you with $8,000. To get back to breakeven, you would need to make a return of 25% on your remaining $8,000 balance.

The deeper the drawdown the worse the picture as the recovery percentage needed begins to grow exponentially. A 50% loss would require a 100% return just to get back to break even.

See the below table for details.

Professional investors are very aware of how difficult it can be to recover from a large account drawdown. The traders who succeed in the long run have developed great respect for risk. Preserving your capital is your primary objective. Traders who have got to the top of the trading game stayed there have done so treating money management seriously and not taking excessive risk. They have done this by understanding and managing risk and implementing proper money management.

There are many stories of great traders started with small sums that they built into a fortune in very little time. These stories and the business of trading are romanced and usually fail to mention that many of these traders did not implement good money or risk management and were eventually wiped out. The difficulty in recovering from loss and the importance of good money management is very clearly illustrated above by observing the exponential growth percentage needed for recovery as a percentage of the drawdown.

Summary

Sound money management involves assessing the risk/reward of your trades on an individual and account why basis. Drawdown refers the percentage of your account lost between reaching new equity highs in your account. As drawdowns increase, the difficulty of recovery increases, to the point of becoming impossible. Some traders have shown exceptional results in the short term but eventually these uncontrolled risks catch up and destroy their account. Professional traders with a track record of long-term success understand and control the risk they take by implementing proper money management.

~~~~~~~~~~~~~~

In the next Article; Money Management Part 2. We will look briefly at how money management can range from a basic commonsense approach to complex portfolio management theories. What you will be pleased to know is that you don’t have to be a scientist or mathematician and that a straightforward simple method can be the best approach for most traders. In part two we will look at the money management guidelines that if followed will contribute significantly to your long-term success.